Intro

www.Aspirecreditcard.Com Acceptance Code – This article is for those who receive their acceptance code in their mail for their Aspire Credit Card. In this article, you get to know about Aspire credit cards. For example, its benefits, how to activate it, what to do after receiving your Acceptance Code and much more. The Aspire Platinum Credit Card of IDBI Bank is for those who aspire to more rewards and convenience in every walk of life.

The www.aspirecreditcard.com acceptance code is the official website for applying for Aspire credit card. It is working for lower-income and self-employed customers with a target to make their lifestyle easy by providing credit to them. It teaches the habit of credit by making a history of credit providing lower-income and also, self-employed customers.

Aspire Credit Card is a great Credit Card if you have fair credit (or above). Their APR is relatively high (above 20%). This card is designed to provide you with best-in-class travelling, dining, and lifestyle privileges and meet your other aspirational needs.

How To Get An Aspire Credit Card?

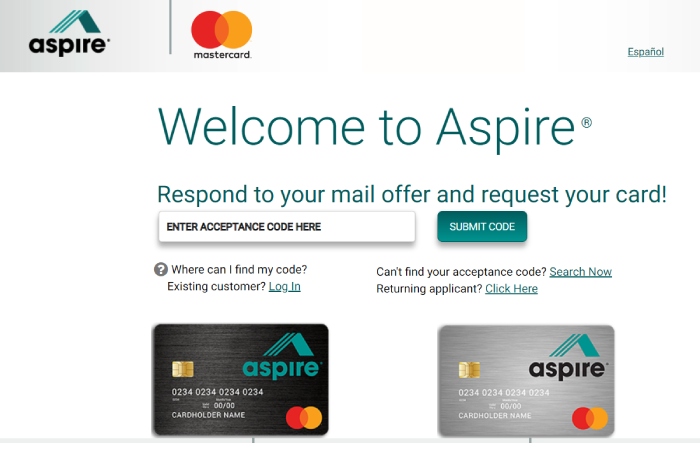

The process is very vibrant from the bank side. Aspire Credit Card applicants get mail that includes an acceptance code and can submit it to its official website, www.aspirecreditcard.com and then claim their Aspire Credit Card. They will choose their customer and provide an invitation code known as the acceptance code popularly. The bank also includes an acceptance code for Aspire Credit Card to its selected applicants on basis of their strategy basis on age and income.

To get a card, check if you pre-qualify at https://www.aspire.com/pre-qualify.

- Pre-Qualify for Up To $1000.

- Credit Limit Subject to Credit Approval.

- Even Less Than Perfect Credit Accepted

- No Program Fees or Initial Deposit is Needed To Open an Account.

- Pre-Qualify Without Impacting Your Credit Score.

Activation Of Aspire Credit Card

Activate your Aspire Card online or call (855) 802-5572. And also have one more way to activate your Aspire Card: the card issuer’s mobile app.

While after a few minutes of activation, your new Aspire Card will be ready to make purchases no matter your method. It does not have a time limit for activating your card, but it’s best to do it as soon as possible.

How to Activate an Aspire Card

The three ways of activating an Aspire card are given below;

- By phone: You can call (855) 802-5572 or the number on the sticker. Thus, which is attached to the front of the card. Verify your personal information, for example, your Social Security number, card number, or phone number associated with your application to activate your Aspire Card.

- On the website: Login to your Aspire account (or create an account if you don’t have one), find the activation page, and also, enter the required security information. Activate your Aspire Card as instructed.

- On mobile: Log in to the Aspire mobile app (for iOS or Android) using the same credentials you’d use to log in online. Tap the credit card activation key, then enter any requested security information on the following page.

Hence, if you have issues activating your card, aspire customer service can always help you. You can give them a call at (855) 802-5572.

Benefits Of Using Aspire Credit Card

Aspire Credit Card offers many benefits to their customers. Some of the benefits are:

- It has a $1,500 credit limit

- You get 2% cash back on purchases.

- It also provides you with a $59 annual fee.

Abandonment on the first-year maintenance fee will be $60 from the second year. But to receive these benefits, you need to have an Aspire Credit Card. And to apply for that, you are required to have an acceptance code. Thus, you could proceed with your application if you received the acceptance code in your mail.

Requirement for Aspire Credit Card Acceptance Code

Every credit-providing company sets some requirements to get a better chance and only select capable people who can return their provided money with additional income to the company in time. So Aspire Credit Card also has some requirements to get it, which are following below;

- You are required to have social security number belonging to you.

- You should have your Govt—I.D. card as proof.

- A credit score plays a vital role in applying for any credit from whichever bank you visit nowadays. For Aspire credit card, you need at least around a 630-credit score.

What To Do After You Receive Acceptance Code From www.Aspirecreditcard.Com?

- After you receive Acceptance Code in your mail, follow these steps to proceed with your application.

- Go to the official site of Aspire Credit Card- www.aspire.com from your web browser.

- On the website’s homepage, you’ll see a response to an offer on the top right of your screen.

- Click on it, and a new page will open. On that, enter your Acceptance Code.

- Then click on Submit button.

5 Things to Know About the Aspire Credit Card – www.Aspirecreditcard.Com Acceptance Code

1. There’s a prequalification process

When you receive a mail offer for the Aspire credit card and use the acceptance code to apply on the card’s website, channeled through a prequalification process that allows you to see your approval odds. There’s no impact on your credit scores to explore the offers.

Once you accept an offer, a hard inquiry will apply that can temporarily cause credit scores to drop. It’s common to see this action after submitting a credit card application with most issuers.

2. It’s heavy on the fees

The fees on this card make it expensive to hold for the long term, and the pricing may vary depending on eligibility. Here’s a look at the potential costs:

- An annual fee ranges from $49 to $175 depending on your creditworthiness; after that, it’s $0 to $49 annually.

- An account maintenance fee ranges from $60 to $159. You pay it in full the first year, then on a monthly cadence afterward.

- Late fees: Like other credit cards, a late fee of $41 may apply for a missed payment.

- Authorized user: You’ll pay $19 to add another user to your account, and many cards don’t charge a fee to add an authorized user.

3. Carrying a balance is expensive

It’s not uncommon for credit cards to have a high-interest rate when you have less-than-perfect credit; this card is no exception. The interest rate is sky-high, ranging from 22.74% to 36% (as of March 2023), depending on your creditworthiness.

The card’s annual and monthly maintenance fees and the possible interest rate charged for ongoing balances can catapult you into debt if you’re not prepared to cover the costs.

4. Balance transfer and cash advance options are pricey, too

The Aspire Credit Card offers a balance transfer option, but it’s not worth pursuing to pay down debt. As of this writing, the steep interest rate (25.74% to 36 percent, depending on creditworthiness) and the 3% fee aren’t a debt-busting combination.

An excellent balance transfer option provides a 0% introductory APR to pay down debt, but these offers to reserve for those with good credit scores of 690 or higher. Even with less-than-ideal credit, you still have potentially more affordable get-out-of-debt options.

5. Think twice about occasional deferred interest offers

The Aspire Credit Card might occasionally offer deferred interest promotions, but it’s essential to understand the terms before accepting one. Generally, a deferred interest offer allows you to finance a purchase and avoid interest charges for a specific time if you can pay off the balance by the deadline.

It can be helpful if you need some time to pay down a large purchase, but it can also put you at risk for the debt if you can’t pay it off by the promotion’s expiration date. Failing to pay off the entire balance on time leaves you on the hook for all the interest charges accrued throughout the promotional period.

Conclusion

Hence, Aspire Credit Card cardholders may encounter issues or queries regarding services or offers. They can contact Aspire Credit Card team’s customer support through any options below.

- The Official Link to Contact Aspire: https://www.aspire.com/contact/

- The phone number for Customer Support Aspire: 855-802-5572

- And the mailing address for Aspire Account Services: is P.O. Box 105555, Atlanta, GA 30348-5555.

Related posts

Featured Posts

What Is A Web Project? – Phases For Planning, and More

Introduction Web Project The term ” web project ” can designate different development types, including technical creation, content management, data,…

10 Benefits of Eating Roasted Gram

In this article, we will talk about the 10 benefits of eating roasted gram. The roasted gram is also known…