This article will cover the perspective of a golden opportunity to invest in Jio IPO. As per the update, 2022 was also expected to be great for IPO, and the Economic Times quoted CLSA as saying that Reliance will separate its telecom business this year, and Jio will be listed in the stock market. According to rating agency CLSA, the IPO of Reliance Jio will boost the telecom sector. This year will also see essential developments regarding 5G.

The 5G spectrum will be put up for sale this year, according to CLSA research. In addition to this, Reliance Jio’s IPO may occur. Jio received investments of Rs 1.53 lakh crore from 13 significant investors worldwide during the Corona period 2020. Nearly 33 percent of Jio’s equity is held by these 13 investors. In addition, Facebook has a 10% investment, and Google has an additional 8%. Jio had received 33737 crores from Google and 43574 crores from Facebook as investments.

Intro of Reliance Jio

India’s largest telecom company and top 4G service provider is Reliance Jio. One of the biggest companies in the nation, Reliance Industries Limited (RIL), is its owner gets companies in the country, Reliance Industries Limited (RIL), is its owner. The company’s creative strategy and aggressive pricing practices have allowed it to function profitably. It currently provides an IPO in the Indian markets, which may give investors a tremendous chance.

Reliance Jio is one of the great profitable businesses in India, and its IPO could be a golden opportunity for investors. It has a solid client base of over 300 million and is well-positioned to profit from the growth of digital payments and the IOT [Internet of Things]. Additionally, it is strategically positioned to benefit from expanding the Indian telecom industry and the rising need for data services.

Investors should consider the IPO of Reliance Jio as an golden opportunity to invest and gain contact with a high-growth division and benefit from the company’s strong fundamentals. It is anticipated to be a very successful product and might give long-term investors favorable returns.

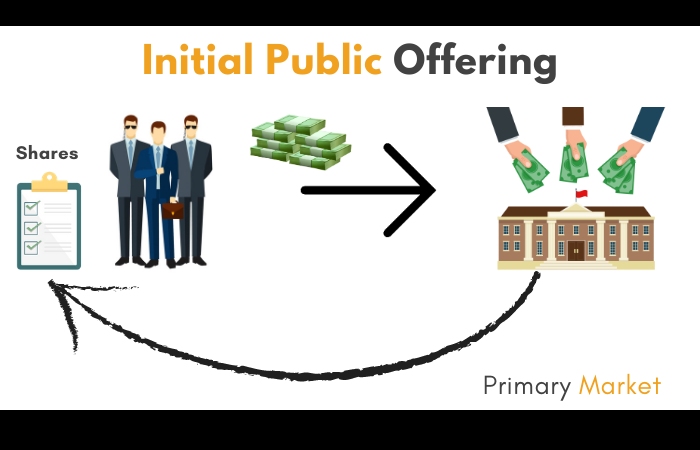

What is an IPO [Initial Public Offering]?

![What is an IPO [Initial Public Offering]_](https://www.thetechiesblog.com/wp-content/uploads/2023/05/What-is-an-IPO-Initial-Public-Offering_.jpg)

An Initial Public Offering (IPO) refers to a process that gives the public access to a business’s shares, enabling them to invest in it. It is the first time a company has gone public, meaning it remains now traded on the stock exchange. As a result, the corporation can raise money by marketing its shares to the public and with the money to finance its growth. For instance, Reliance Industries Limited (RIL) is offering an IPO for its subordinate, Jio Platforms Limited (JPL).

Investors have a once-in-a-lifetime chance to participate in this ground-breaking project and secure a stake in one of India’s most exciting technological firms. RIL is currently offering Jio shares at a competitive price, and investors are still anticipated to be quite interested in JPL’s stock market debut. Investors have a fantastic opportunity to diversify their holdings and exploit this cutting-edge technology company’s development potential.

What Is the IPO Process?

The IPO process involves two parts. The first is the pre-marketing stage of the offering, whereas the second is the initial public offering itself. The underwriters lead the IPO process and are select by the company. In addition, a company may select one or several sponsors to manage different shares of the IPO process collaboratively. The sponsors are involves in the IPO due diligence, document preparation, filing, marketing, and issuance.

Steps to an IPO

- Proposals – In proposals and valuations discuss their services, the best type of security to issue, the offering price, the amount of shares, and the estimated time frame for the market offering.

- Underwriter – The company chooses its underwriters and formally agrees to underwrite terms through an underwriting agreement.

- Team – IPO teams comprise underwriters, lawyers, certified public accountants (CPAs), and Securities and Exchange Commission (SEC) experts.

- Documentation – Information about the company is compiled for required IPO documentation. The S-1 Registration Statement is the primary IPO filing document. In addition, it has two parts—the prospectus and the privately held filing information.

- Marketing & Updates – Marketing materials are created to pre-market the new stock issuance. Underwriters and executives market the share issuance to estimate demand and establish a final offering price. In addition, underwriters can review their financial analysis throughout the marketing process.

- Board & Processes – Manage a board of directors and confirm processes for quarterly reporting of auditable financial and accounting information.

- Shares Issued – The company issues its shares on an IPO date. Capital from the primary issuance to shareholders is received as cash and recorded as stockholders’ equity on the balance sheet. Subsequently, the balance sheet share value becomes comprehensively dependent on the company’s stockholders’ equity per share valuation.

- Post IPO – Some post-IPO provisions may be institutes. For example, underwriters may have a specified time frame to buy additional shares after the initial public offering (IPO) date. Meanwhile, confident investors may be subject to quiet periods.

Information on the Jio IPO

Be patient if you’re looking forward to a future IPO from the Jio family. Recent reports and claims made by JP Morgan indicate that Reliance Industries Limited was unlikely to announce the launch of any initial public offering (IPO) in 2022. However, despite contradictory reports, investors are still very optimistic about this news.

However, according to the most recent information from investment company JP Morgan, consumer business valuations had held up well, and with Jio telecom users earning more money than the industry average, this should continue to be true. Therefore, it inspires the investment community to launch an IPO outside Reliance Jio’s home.

Reliance Industries is unlikely to launch the IPOs of its twin telecom and retail consumer businesses this year or sell a stake in the new energy business, according to global investment bank JPMorgan Chase. At the conglomerate’s annual general meeting (AGM) last year, RIL chairman Mukesh Ambani told shareholders he would give an update on the IPO in his AGM speech this year. Earlier in 2019, the billionaire mentioned listing these businesses in the next five years. Reliance has already elevated funds from numerous investors for Reliance and Jio Retail.

In the Words of the Chairman Mukesh Ambani

Investors are confident in the business, Reliance Jio’s reputation and the company’s high-performance levels from quarter to quarter of each passing year are prevalent in today’s stock market. Interestingly, Mukesh Ambani announced in 2019 that some of his companies, including Reliance Jio, would go public over the next five years. Consequently, it states at the AGM of 2019.

According to reports, the chairman mentioned that Reliance Retail and Reliance Jio had received positive interest from financial and strategic investors. A goal was also to launch a few elite international alliances and undertake listings. Following this, several enthusiastic investors were quite excited and expected a swift announcement of an IPO. If the information becomes public, investors waiting for the Jio IPO to get traction can act immediately. You can accomplish this without creating a demat account.

Only Growth

Since Mukesh Ambani’s very telling announcement in his 2019 AGM, RIL has managed to raise funds from numerous investors for Reliance Jio. According to a recent report, Goldman Sachs stated that the retail revenue of RIL has grown by 45% in FY22. RIL has significant dominance in the telecom industry, and if any upcoming IPO is declare, it will have numerous takers. However, you needn’t worry about prep. As for expression about RIL as a corporation, you are already aware of its major success in all segments in which it has a presence.

How to Invest in a Jio IPO

- Investing in Jio IPO is a golden opportunity to benefit from the development of the digital economy in India. Jio is a telecommunications company that has transformed the industry with its low-cost services and has become a front-runner.

- The business is currently initiating its IPO (initial public offering). As a result, investors have a fantastic opportunity to profit from Jio’s phenomenal growth potential.

- Investing in an IPO can be a complex process, and it is vital to understand its risks. Investors will need to deliberate on the company’s fundamentals, its competitive scenery, and its financials. In addition, researching the company’s historical performance, current market conditions, and industry trends is essential.

- Understanding the company’s competitive advantages and potential opportunities is also significant. Once the investor remains satisfied with the company’s fundamentals, they should make a conversant decision on whether or not to invest in the Jio IPO.

- Investors must choose their investment strategy after participating in the Jio IPO. An IPO investment can still be made through a broker or directly with the business. When the IPO closes, investors can purchase and sell IPO shares on the market through a broker.

- Now investing with the company need investors to fill out an application and deliver banking details. The corporation will then release the IPO stocks to the investors at the end of the IPO phase.

Benefits And Risks of Investing in a Jio IPO

Benefits of Investing in a Jio IPO

- The Jio IPO is a golden opportunity for investors to invest. Since its debut in India, the company has experienced fast growth, and its initial public offering (IPO) promises to produce a sizable return on investment.

- Additionally, Jio’s IPO investment gives investors access to a very profitable business with room for expansion in the future. The firm has already demonstrated its ability to seize significant markets with its cutting-edge goods and services, and the IPO will probably lead to even greater success.

- Investors can also gain from several benefits with the IPO, including access to a low-risk investment, possible capital growth, and access to a business that has already demonstrated profitability. But, of course, the company’s capacity to carry out its plans will determine whether the IPO is a success.

Risks In Investing in a Jio IPO

- Every potential investor should carefully assess the risks of investing in a Jio IPO. The aggressive price strategy used by Jio has contributed to its success in the very competitive Indian cellular market.

- However, the company’s profitability may continue to be impact by changes in the regulatory environment, the competitive environment, or its capacity to produce enough cash flow to fund its operations.

- Each prospective investor should carefully assess the risks of investing in a Jio IPO. Since there is fierce competition in the Indian telecom market, Jio’s aggressive price policy has contributed to some of its success.

- However, changes in the regulatory environment, the competitive environment, or the company’s capacity to produce enough cash flow to fund its operations could continue to impact its profitability.

- Hence, these risks should not remain ignored; the potential prizes of investing in a Jio IPO could outweigh these risks. Moreover, Jio has already achieved remarkable development and could continue to be effective, making it a golden opportunity for savvy investors.

Conclusion

Therefore, the Jio IPO is a golden opportunity for anyone investing in a reliable and robust company. Its greatest strengths are the company’s customer base and capacity for innovation, and speedy product development. In addition, investors might be confident in the company because of its successful products, including its mobile network, in India. Moreover, due to its low entry price, the Jio IPO has a very strong chance of producing profitable returns. Consequently, the Jio IPO is something to consider if you seek a golden opportunity to invest.

Related posts

Featured Posts

What Is A Web Project? – Phases For Planning, and More

Introduction Web Project The term ” web project ” can designate different development types, including technical creation, content management, data,…

10 Benefits of Eating Roasted Gram

In this article, we will talk about the 10 benefits of eating roasted gram. The roasted gram is also known…