AGCB Stock – This article provides information about the AGCB [Altimeter Growth Corp. 2] stock. Altimeter Growth Corp. 2 does not have significant operations. It focuses on effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. Altimeter Growth Corp. 2 originated in 2020 in Menlo Park, California. The current price of AGCB is $11.01. The 52-week high of AGC is $18.11, and also, 52 week low is $10.04.

About Altimeter Growth Corp. 2 (AGCB)

- Altimeter is a leading technology-focused investment firm erected by founders for founders. Their mission is to help visionary entrepreneurs build iconic companies, interrupt markets, and also, improve lives through all stages of growth. Altimeter accomplishes different kinds of venture and public funds and serves as a long-term expert partner to companies as they enter the public markets.

- At Altimeter, essentialism is not just the flavor of the day – it’s an ongoing practice. It’s a key to our culture, whether thinking about organization, compensation, portfolio, investor base, and also, the balance between our work and also, personal lives. We believe strong cultures require repetition.

- Their highly focused team has extensive operational, financial, venture capital, and also, capital markets experience. We are excited and honored to back the entrepreneurs and companies that will help move our global economy forward while positively impacting our communities along the way.

Altimeter Growth Corp. 2 (AGCB) to Liquidate

Altimeter Growth Corp. 2 (NYSE: AGCB) announced that it has decided to liquidate its trust due to its inability to complete a business combination.

The company now plans to redeem all outstanding Classes as part of the liquidation. A common stock share includes in its IPO at a per-share redemption price of approximately $10.11. AGCB expects the close of business to be on December 21, and also, once the shares are redeemed, they cancels.

The SPAC initially announced the pricing of its upsized $400 million IPO in January 2021 to combine with a technology business with a large and growing addressable market and also, differentiated architecture. Altimeter runs by Chairman, CEO, President Brad Gerstner, and also, General Counsel Hab Siam.

What is AGCB Stock Price?

The current price of the AGCB stock is $11.1. It may get more change in few weeks. This company may still be operating; however, this listing is no longer active.

More info regarding the stock is;

- 52wk High – 10.11

- Beta – -0.01978

- PE Ratio – 505.30

- EPS – 0.02

- Close – 10.105

- 52wk Low – 9.70

- Market Cap – 579.52m

- Total Shares – 57.35m

- Shares Out – 46.10m

- PB Ratio – 1.33

Highlights AGCB

Revenue: ALTIMETER GROWTH CORP 2-A’s revenue jumped NaN% from last year to $0Mn in Q3 2022. On a quarterly growth basis, ALTIMETER GROWTH CORP 2-A has generated a NaN% jump in its revenue in the previous three months.

Net Profits: ALTIMETER GROWTH CORP 2-A’s net profit jumped 51.42% from last year to $1.43Mn in Q3 2022. On a quarterly growth basis, ALTIMETER GROWTH CORP 2-A has generated a 337.23% jump in its net profits in the last three months.

Net Profit Margins: ALTIMETER GROWTH CORP 2-A’s net profit margin jumped NaN% from last year to +Inf% in Q3 2022. On a quarterly growth basis, ALTIMETER GROWTH CORP 2-A has generated a NaN% jump in its net profit margins in the last 3-months.

PE Ratio: ALTIMETER GROWTH CORP 2-A’s price-to-earnings ratio after these Q3 2022 earnings stand at 1010.5.

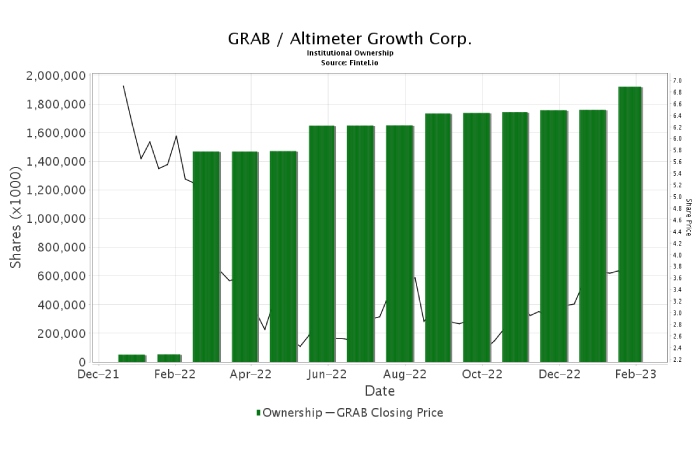

What Does The Institutional Ownership Tell Us About Altimeter Growth Corp. 2?

Institutions characteristically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it’s involved in a primary index. We would guess most companies have some institutions on the register, significantly if they are growing.

Altimeter Growth 2 already has institutions on the share registry. Indeed, they own a good stake in the company, which suggests some credibility between professional investors. But we can’t depend on that fact alone; meanwhile, institutions make bad investments sometimes, just like everyone does. When several institutions own a stock, there’s always a risk that they are in a ‘crowded trade.’ Various parties may compete to sell stock fast when such a trade goes wrong, and this risk is higher in a company without a history of growth.

What Does AGCB [Altimeter Growth Corp] Do?

![What Does AGCB [Altimeter Growth Corp] Do_](https://www.thetechiesblog.com/wp-content/uploads/2023/03/What-Does-AGCB-Altimeter-Growth-Corp-Do_.jpg)

- Altimeter invests in public and private technology companies, focusing on identifying future market-leading companies with large addressable markets, strong management teams, defensible competitive moats, attractive unit economics, and also, reasonable valuations.

- Altimeter’s investment team spends significant time conducting primary due diligence as part of its fundamental, bottoms-up research process. Altimeter aspires to be domain experts in the markets and businesses it invests in.

- Altimeter believes that only a few companies deserve premium multiples and that a long investment horizon, supported by rigorous analysis, is vital in creating outsized returns. As such, Altimeter aims to be a lifecycle investor in select high-conviction companies.

Is Altimeter A Hedge Fund?

- Altimeter Capital Management in Boston is a hedge fund with 17 clients and discretionary assets under management (AUM) of $17,950,309,162 (Form ADV from 2022-05-27). Their last informed 13F filing for Q4 2022 comprised $3,652,571,000 in managed 13F securities and a top 10 holdings concentration of 99.95%.

- Altimeter Capital Management’s largest holding is Snowflake, Inc., with shares apprehended of 15,369,459. Altimeter has met the qualifications for addition to our WhaleScore system. Thus, Whalewisdom has at least 48 13F filings, three 13D filings, 36 13G, and 12 Form 4 filings.

Is Altimeter An Investment Firm?

Altimeter is an investment firm with agencies in Menlo Park, CA, and Boston, MA. The firm’s private equity arm makes all-stage venture capital investments, primarily in technology. The firm also deliberates investments in the consumer products and services, gaming, retail, and also, transportation sectors.

Altimeter’s hedge fund business takes a private equity approach to public market investing, taking long and short positions in companies and sectors with differentiated expertise. Thus, it primarily invests in the technology sector and travel, gaming, car rental, air travel, and also, media.

Conclusion

Hence, Altimeter Growth Corp. 2 holds several positive signals, but we still don’t find these enough for a buy candidate. At the current level, it should be considered a hold candidate (hold or accumulate) in this position while awaiting further development.

Related posts

Featured Posts

What Is A Web Project? – Phases For Planning, and More

Introduction Web Project The term ” web project ” can designate different development types, including technical creation, content management, data,…

10 Benefits of Eating Roasted Gram

In this article, we will talk about the 10 benefits of eating roasted gram. The roasted gram is also known…